Give a Gift, Receive Income

Want to avoid market fluctuations? Want to increase your income flow and leave a gift to Wheaton College? Gift Annuities may be for you!

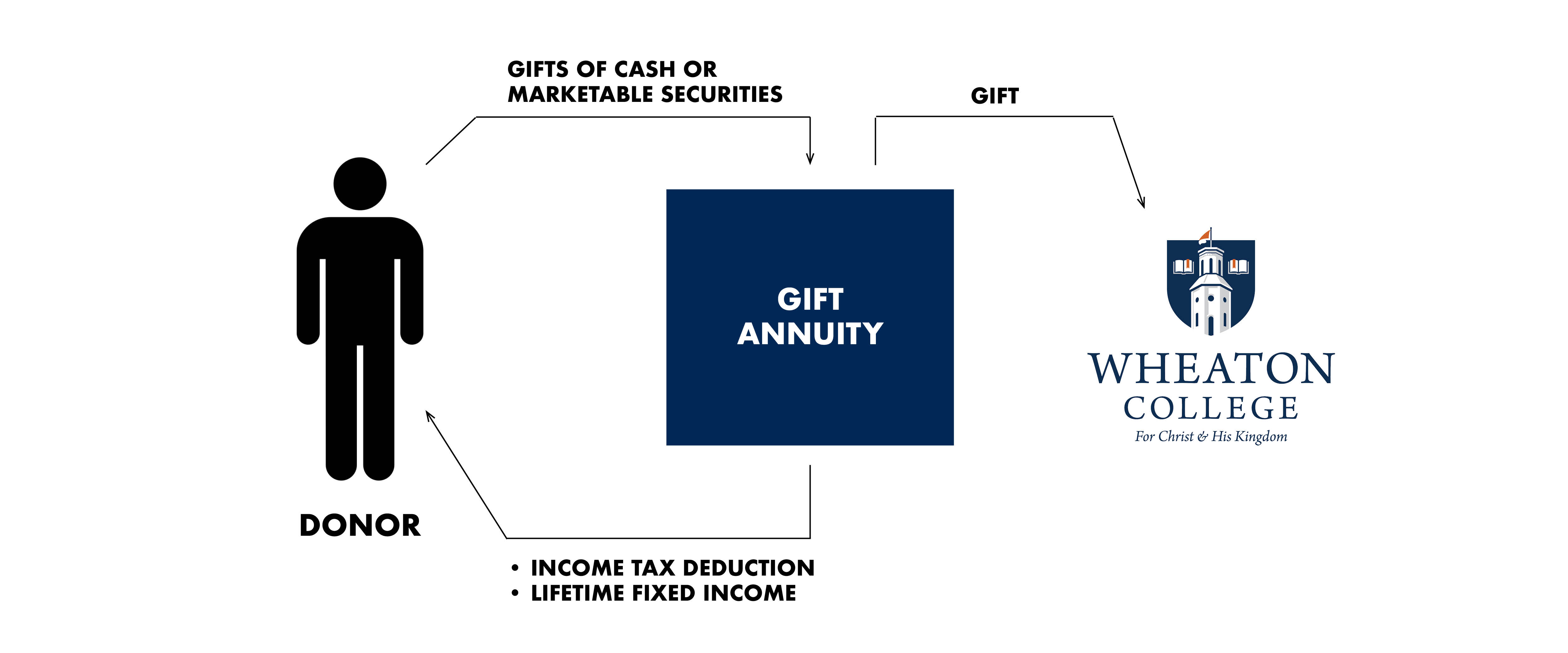

A gift annuity is funded with cash, appreciated sock, or Qualified Charitable Distributions from an IRA. Fixed annuity payouts come to the donor for life and Wheaton receives the remainder after payments completed.

Benefits of a Wheaton College Gift Annuity

- Fixed lifetime payments

- Charitable income tax deduction for the charitable portion of the contribution

- Payments may be partially tax-free

- Wheaton’s financial stability backs gift annuities. Wheaton has offered gift annuities since 1898!

- Further the work and ministry of Wheaton College

How a Gift Annuity Works

- Complete a gift annuity application

- Contribute cash or stock to Wheaton. Minimum funding is $10,000 and income flow increases with higher funding amounts.

- Receive a partial income tax deduction for the charitable portion of the contribution. Annuity payments may be partially tax-free.

- The gift portion furthers Wheaton’s mission!

If you contribute appreciated stock, ETFs, or mutual funds, you will partially avoid the capital gains that would have been due at a sale and stretch out recognition of remaining capital gains over the life of your annuity payments.

Since 2023, IRA owners over age 70 ½ can fund a gift annuity from their traditional (tax-deferred) IRA! A Gift Annuity provides a lifetime income flow and a gift to Wheaton. If funding with QCDs, please note:

- The maximum contribution amount is currently $54,000, funded only in one single calendar year and once in a lifetime. A donor may fund one or more gift annuities with QCDs, not to exceed the maximum.

- Each spouse can make QCDs from their own IRA to fund a gift annuity up to $54,000.

- Only the IRA owner or owner’s spouse may be an annuitant.

- Payments cannot be deferred.

Learn more about Qualified Charitable Distributions from your IRA.

Contact Us

If you have any questions about charitable gift annuities, please contact us at 630.752.5332 or gift.plan@wheaton.edu. We would be happy to assist you and answer your questions.

Additional Information

Current Payment Gift Annuity

Increase your current income flow, as these payments begin promptly – as early as within 3 months of the contribution.

Deferred Payment Gift Annuity

Supplement future retirement income flow, as these payments begin at least 1 year out. You can establish the gift annuity now and defer payments to a later date. You will receive an immediate tax deduction and typically a higher payment rate.

Flexible Deferred Gift Annuity

Not sure when you’ll want payments to start? Enjoy the flexibility of being able to decide later when they begin. You can establish the gift annuity today, receive an immediate charitable deduction, and defer payments until you want to begin receiving them. Some limitations apply, so please contact us for details.

Sample Gift Annuity Rate Table

Single Life Current Payment Gift Annuity Rates for $10,000 Contribution

|

Age |

Payment Rate |

Annual Payment (paid quarterly) |

|

60 |

5.2% |

$520 |

|

65 |

5.7% |

$570 |

|

70 |

6.3% |

$630 |

|

75 |

7.0% |

$700 |

|

80 |

8.1% |

$810 |

|

85 |

9.1% |

$910 |

|

90 |

10.1% |

$1,010 |

/prod02/channel_1/media/giving/GPS-brochures.jpg)