Gifts of Real Estate Provide Unique Tax Benefits

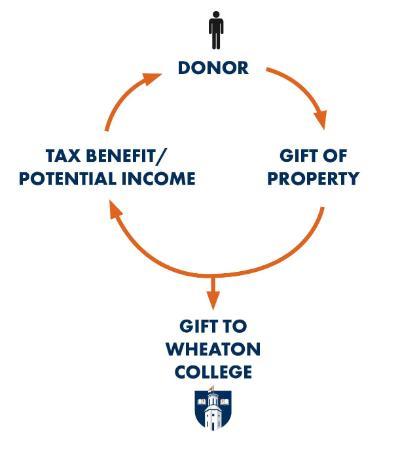

If you own appreciated real estate, you may face significant capital gains when it is sold. Wheaton has a long history of facilitating real estate gifts – donors receive unique tax benefits while making a meaningful impact gift that will support Wheaton’s ministry.

- Get an income tax deduction for the fair market value of the real estate

- Avoid capital gains taxes that would be due at a sale

Wheaton can receive various types of appreciated real estate, including:

- Vacation home

- Farmland

- Vacant land

- Rental property

- Commercial real estate

Gift Options

- Give the entire property now – get deduction for full property value

- Give an undivided partial ownership interest now (and keep/sell the rest)

- Fund a Charitable Remainder Unitrust – receive lifetime payments and a partial tax deduction

- Give it now and continue to live in it until your death – get a partial tax deduction now

- Give it to Wheaton through your estate plan at your death – maintain full control during your life